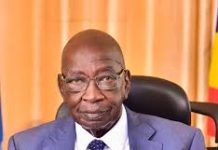

Minister Amos Lugoloobi yesterday 18th April, 2024 provided an update on the outcomes arising from the meeting with Ministry of Trade and traders concerning the pressing issues affecting them, particularly the implementation of the Electronic Fiscal Receipting and Invoicing Solution (EFRIS). During the session, Minister Amos Lugoloobi conveyed that traders had put forth a proposal to the government, urging for an increase in the VAT threshold from Shs150 million to Shs1 billion, alongside a reduction in the VAT rate from 18% to 16%.

Highlighting the concerns voiced by traders, Minister Amos Lugoloobi pointed out that the EFRIS system posed several challenges, including the high cost of compliance and the lack of understanding among traders, irrespective of their VAT registration status. The minister assured that Ministry of Finance would undertake a thorough study and consultation on the proposal within the next two weeks.

In response to the discussions, various Members of Parliament expressed their viewpoints on the taxation policies and their impact on traders. Hon. Isaac Otimgiw from Padyere County criticized the Ministry of Finance and Uganda Revenue Authority (URA) for failing to recognize traders as significant stakeholders in tax generation, alleging that they were only seen through an enforcement lens without being involved in negotiations.

Similarly, Hon. Godfrey Onzima from Aringa North raised concerns about the apparent bias in the application of tax policies, emphasizing that local traders bore the brunt of taxation while investors seemingly enjoyed preferential treatment.

“Investors don’t pay taxes but it is the local traders who are struggling with taxes. These are issues that we need to address if we are to promote our competitiveness.” Onzima said

Hon. Juliet Bashiisha of Mitooma District shared her experience of being charged a high VAT rate of 35% on reusable pads, calling for more nuanced tax regulations that cater to essential items.

“URA told me that even women’s knickers which are sold between Shs2,000 to Shs10,000 are charged 35% VAT which is big. I request that garments should not be generalised.” Juliet said

State Minister for Planning, Hon. Amos Lugoloobi, highlighted Uganda’s historically low tax-to-GDP ratio, stating that it stood at around 13%, significantly lower than the sub-Saharan average. He reiterated that the EFRIS initiative aimed to expand the tax base by ensuring compliance among previously non-compliant individuals and businesses.

“ EFRIS measure is intended to broaden the tax base. This is when people who have been running away from paying tax are got to make them to pay.” State Minister Amos stated

To facilitate the adoption of EFRIS among traders, Minister Amos Lugoloobi proposed the establishment of taxpayers’ service offices in key locations such as Kikuubo. This measure aimed to enhance accessibility to training and support services for traders navigating the new tax system.