By David Mwanje

Uganda’s economy expanded by 6.3% in FY2024/25, outpacing the previous year’s 6.1% and signaling broad-based growth driven by agriculture and industrial activity, according to the Bank of Uganda’s State of the Economy Report for September 2025.

Released via its official X/Twitter page, the report indicates that agriculture surged by 6.6% while industry grew by 7.0%, bolstered by a robust 12.2% rise in construction. However, the central bank cautions that projected growth of 6.0%–6.5% in FY2025/26 will be vulnerable to climatic disruptions, geopolitical instability, and electoral-related uncertainties, positioning economic continuity as contingent on sustained macro-stability and policy discipline.

The report highlights agriculture’s recovery, with livestock up 8.8% and fishing rebounding 17.8%, alongside industrial gains in electricity (10.3%) and manufacturing (5.5%). Inflation remained tame, averaging 3.5% over the past 12 months, with August 2025’s headline figure steady at 3.8% and core inflation at 4.1%, thanks to prudent monetary policy and stable food supplies. BoU Governor Michael Atingi-Ego emphasized this stability in a recent statement “Our cautious monetary stance, maintaining the Central Bank Rate at 9.75%, has shielded Ugandans’ incomes and savings while fostering investor confidence amidst global headwinds.” This policy, he added, supports the government’s Tenfold Growth Strategy, aiming to expand the economy from USD 61.3 billion to USD 500 billion by 2040.

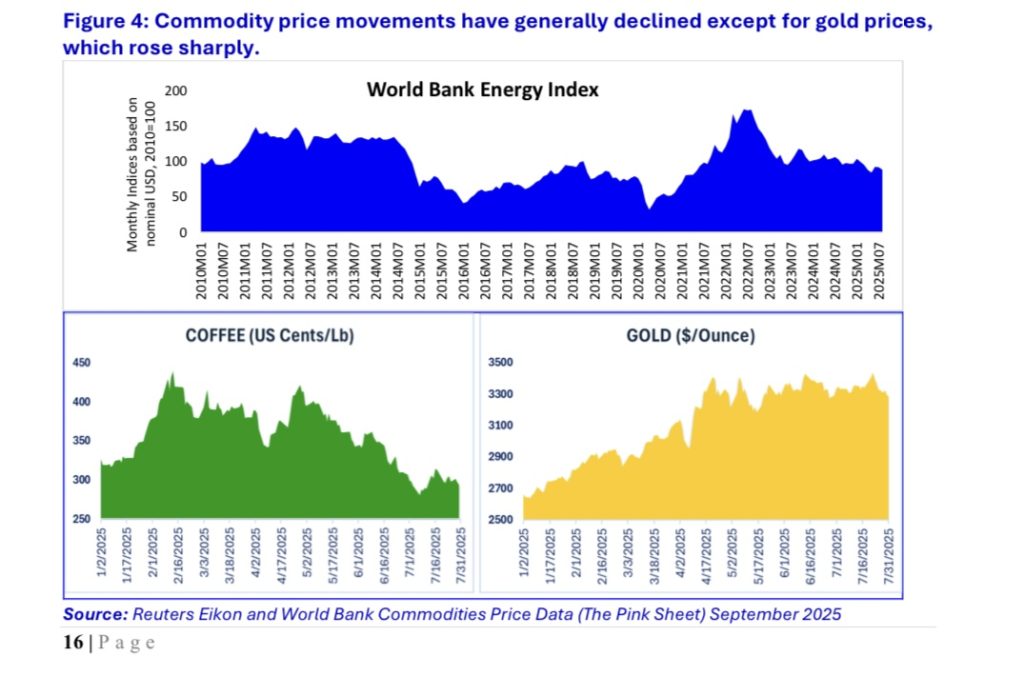

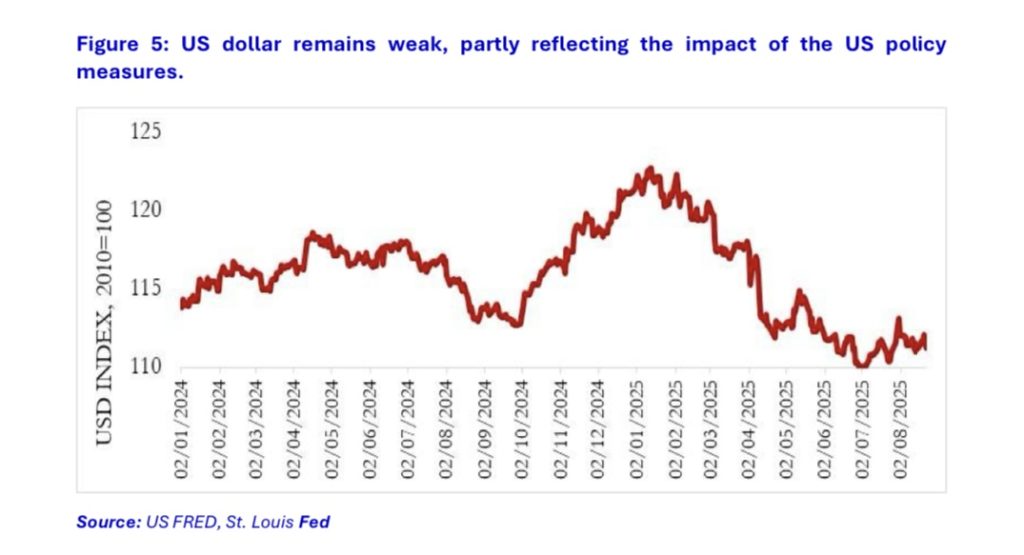

Foreign direct investment (FDI) in the oil sector surged to USD 3,615 million, bolstering a financial account surplus of USD 4,465 million. Exports, particularly coffee and cocoa, grew 37.2% to USD 11,071 million, narrowing the current account deficit by 12.2% to USD 3,721 million. However, the report warns of downside risks, including a potential 1% tax on U.S. remittances under the One Big Beautiful Act (effective January 2026), which could dent inflows critical for many households. Atingi-Ego noted, “We are vigilant about external shocks like falling coffee prices and reduced aid, ensuring reserves of USD 4,576 million safeguard our currency stability.”

Finance Minister Matia Kasaija, delivering the FY2025/26 budget strategy in June 2025, echoed this optimism: “Starting FY2025/26, the NRM government is committed to growing our economy from USD 50 billion to USD 500 billion by 2040, leveraging oil and agriculture.” He highlighted a fiscal deficit of 6.1% of GDP in FY2024/25, lower than the projected 7.0%, driven by a 16.1% tax revenue increase to UGX 29,871 billion. Yet, rising public debt to 51.3% of GDP and interest payments at 4.4% signal fiscal pressures. Kasaija assured, “We are repurposing resources to prioritize human capital and infrastructure, ensuring sustainable growth for all Ugandans.”

For the average Ugandan be it a farmer in rural masaka or a trader in Kampala this growth translates to tangible, yet conditional, benefits. The agricultural boom could boost incomes for the 70% reliant on subsistence farming, where productivity rose just 26% historically. Industrial growth may spur jobs in construction and manufacturing, while stable inflation keeps essentials like food and fuel affordable. However, the report’s risks adverse weather threatening crops or electoral uncertainty curbing spending could reverse these gains. The looming remittance tax might hit families dependent on diaspora support, a lifeline for many.

The BoU’s focus on financial inclusion, via digital platforms like Wendi and credit schemes like the Parish Development Model, aims to broaden these benefits. Yet, high lending rates at 19.1% and structural rigidities mean small businesses and borrowers face hurdles. Analysts suggest that while the economy’s trajectory is promising, everyday Ugandans need policy focus on rural infrastructure and affordable credit to fully reap the rewards. As Atingi-Ego concluded, “Our foundation is strong, but resilience through diversification and reform will determine our tenfold success.”